Money Matters

How to stay rich: Start your own business

Business or side-hustle? However you define it, the growth of women-owned start-ups is gathering steam.

Even in this modern age of female empowerment, condescension abounds. A well known meme has been making the rounds again, the one that goes: “You are lower class if your wife works, middle class if your wife stays home, and upper class if your wife starts a business that loses $10,000 a month.”

Charming. But, in fact, should we take a second look at the nature of hobby businesses—enterprises that originate from a person’s passion and aren’t necessarily intended to make money? Are they just a foible of the leisure class, or are they a valid way to convert passions into productive ventures?

Obviously, not everyone who starts their own business will succeed; in fact, the Bureau of Labor Statistics estimates that 65 percent of new businesses fail within ten years, for any number of reasons. Women entrepreneurs often struggle with a particular set of barriers: a resume gap after years off for childcare, a lack of financial acumen (no matter how good their idea/product may be), and a still ubiquitous gender bias that manifests in ways ranging from condescending memes to lack of networking opportunities and difficulty accessing funding.

Casual disparagement of “hobby businesses” notwithstanding, the growth of women-run start-ups has been gathering steam, perhaps fueled by the #Me Too movement and the post-Covid desire for increased work flexibility. It could also be that there has been an increased recognition of the mental health benefits of peer (i.e., adult) interaction and the sense of purpose associated with having a regular occupation outside of home-making.

Whatever the reasons, according to payroll platform Gusto, women-owned new startups were 47 percent of the total in 2022, up from 29 percent in 2019.

Most of those businesses are genuine efforts to create viable companies, but it’s also worth being aware of the tax implications of losing money. In fact, the potential tax benefits of certain hobbies and side businesses have long been well known to the ultra-wealthy: passions like horse-racing, wine-making, newspaper publishing, and other typically unprofitable ventures have the dual benefit of enjoyable leisure time activity combined with significant tax write-offs. The IRS has tried over the years to police that sort of thing, but a good tax advisor can help to (legally) maximize the tax deductions.

The most recent Organisation for Economic Co-operation and Development (OECD) report on gender disparities in business financing highlighted a number of troubling inequities: women still receive less than 2 percent of all venture capital; women seeking working capital for their businesses were often subjected to higher interest rates and higher collateral requirements; and in the U.S., despite representing 40 percent of the country’s wealthiest people, women made up less than 20 percent of angel investors (those specializing in start-ups).

This state of affairs is, of course, deeply frustrating—not to mention infuriating, insulting, and completely illogical: according to multiple studies, women-led ventures perform better than those run solely by men on multiple metrics, including revenue per dollar invested and return on equity.

For women who have a passion they want to turn into a profitable vocation, start-up capital in the form of family money or a wealthy spouse is certainly a blessing, but the first steps might still be intimidating. Luckily there are now numerous programs intended to help women build the know-how without having to go back to school and get an MBA.

The federal government, in the form of the Small Business Administration, runs a free program called Ascent, which provides robust online tutorials on topics like marketing, budgeting, strategic planning, and—yes—access to funding.

The Tory Burch Foundation, among others, offers an incubator program for female entrepreneurs. In addition to webinars and other resources, in early 2023 the site launched the Funding Finder, an interactive tool that breaks down capital options and resources for women-owned businesses. It offers information on loans and grants and is accompanied by a short quiz that provides specialized answers for founders regarding their capital needs and wants for expanding their businesses.

Nixon Gwilt Law publishes an annual list of women-oriented venture capital firms and accelerators and there are small business loan programs oriented towards women, updated regularly by NerdWallet.

Of course sexist tropes about women starting their own businesses—the “that’s adorable darling” school of (mostly-male) thought—will always have a place to flourish. But so, too, will that deep desire to create something out of nothing—which is, after all, at the heart of any new, and sometimes successful, enterprise.

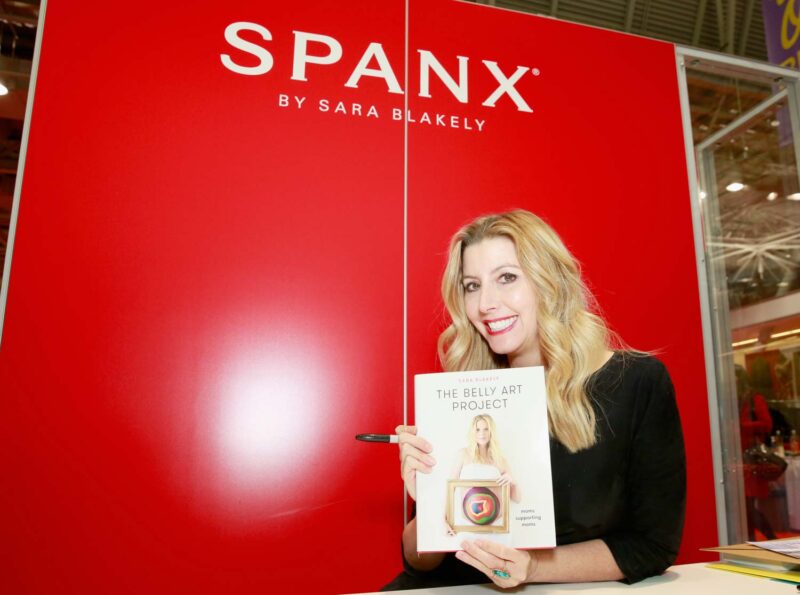

So the next time you’re rolling your eyes at a friend’s money-losing “business”, think of Sara Blakely, who was just a saleswoman who wanted to eliminate panty lines under her suit. She cut the feet off her pantyhose and wore them. It worked. She thought it would be cool to make pantyhose without feet that would sort of smooth her under her clothes.

Now we call that little side hustle . . . Spanx.

Hero image conceptual art created with Midjourney AI